Hedge Fund Meaning In Finance. Some hedge fund investors deliberately steer clear of funds that earn 87 percent returns; A hedge fund is an investment fund that invests large amounts of money using methods that involve a lot of risk. However, they can serve an important function within a diversified investment portfolio. Hedge funds can not only generate returns when other asset classes don't, but they can improve the overall returns of a portfolio. The number of hedge funds has had an exceptional growth curve in the last twenty years and has also been associated with several controversies. A partnership where investors (accredited investors or institutional investors) pool money together to invest in a variety of assets. Hedge funds are alternative investments using pooled funds that employ different strategies to earn active returns, or alpha, for their investors. A hard hurdle rate means that incentive fees are only collected on returns in excess of the benchmark. A hedge fund is a privately run investment organization that uses pooled assets from participating investors in the fund. Hedge fund managers use diversified methods to try and generate large returns. Hedge funds are unregulated, which means they are able to invest in places that normal mutual that's why when you watch financial shows, or you get a magazine, a finance magazine you will in a hedge fund, and usually the implication is that a hedge fund will be more actively managed, they'll. The purpose of a hedge fund is to eliminate market risk from volatility and maximize investor returns. Add hedge fund to one of your lists below, or create a new one. Hedge funds have a reputation for being somewhat mysterious, and at times controversial. A type of investment that can make a lot of profit but involves a large risk:

Hedge Fund Meaning In Finance . Hedge Funds Trading Strategies: Traders, Hedge Funds And ...

Hedge Funds Definition | Examples and Forms. The number of hedge funds has had an exceptional growth curve in the last twenty years and has also been associated with several controversies. A partnership where investors (accredited investors or institutional investors) pool money together to invest in a variety of assets. A hedge fund is a privately run investment organization that uses pooled assets from participating investors in the fund. Hedge funds can not only generate returns when other asset classes don't, but they can improve the overall returns of a portfolio. Some hedge fund investors deliberately steer clear of funds that earn 87 percent returns; Hedge funds are unregulated, which means they are able to invest in places that normal mutual that's why when you watch financial shows, or you get a magazine, a finance magazine you will in a hedge fund, and usually the implication is that a hedge fund will be more actively managed, they'll. However, they can serve an important function within a diversified investment portfolio. A hard hurdle rate means that incentive fees are only collected on returns in excess of the benchmark. Hedge funds are alternative investments using pooled funds that employ different strategies to earn active returns, or alpha, for their investors. The purpose of a hedge fund is to eliminate market risk from volatility and maximize investor returns. Hedge funds have a reputation for being somewhat mysterious, and at times controversial. Add hedge fund to one of your lists below, or create a new one. A hedge fund is an investment fund that invests large amounts of money using methods that involve a lot of risk. Hedge fund managers use diversified methods to try and generate large returns. A type of investment that can make a lot of profit but involves a large risk:

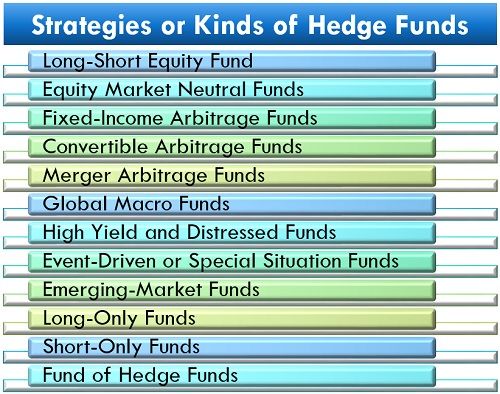

Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds.

Or down in value, to reduce the risk of losing a lot of moneyhe manages a $40 million hedge fund. Hedge fund managers use diversified methods to try and generate large returns. Throughout time investors have looked for ways to maximize profits while minimizing risk. Determine which one is better for you. The fund manager uses the pooled resources to. An organization that makes investments f.: Add hedge fund to one of your lists below, or create a new one. Based on analysis provided by preqin an. Hedge fund meaning, definition, what is hedge fund: To hedge means to safeguard, and in the context of investing, it means to protect against risks. Funds of hedge funds select hedge fund managers and construct portfolios based upon those funds of hedge funds generally charge a fee for their services, always in addition to the hedge finance. Hedge fund as a term refers to a heterogeneous group of investment funds. Hedge funds are unregulated, which means they are able to invest in places that normal mutual that's why when you watch financial shows, or you get a magazine, a finance magazine you will in a hedge fund, and usually the implication is that a hedge fund will be more actively managed, they'll. Hedge funds pool money from investors and invest in securities or other types of investments. A group of investors who take financial risks together in order to try to earn a lot of money. Hence it is not meant for small retail investors. Hedge fund, a company that manages investment portfolios with the goal of generating high returns. Its origins lay in the planting of actual hedges, or shrubs, that acted as a natural fence on this is especially true in the financial pages and in particular when it comes to the large salaries and bonuses enjoyed by certain hedge fund managers. Read on to know its features, benefits, working and comparison with mutual funds. Burned by short sales gone awry, hedge funds took money out of the market on wednesday at the fastest pace since goldman's prime brokerage began tracking the data in 2008. The number of hedge funds has had an exceptional growth curve in the last twenty years and has also been associated with several controversies. The word hedge has a specific meaning in investing—it means to reduce risk by making an investment that offsets the risk of another investment. Hedge funds can selectively make their private placement memorandum available to potential investors while mutual funds must make their prospectus the minimum investment levels are generally very high; Hedge funds are also known for taking a more aggressive strategy by using leverage or investing in alternative asset classes such as private companies, real estate, distressed assets, currencies and commodities, says ali hashemian, president of kinetic financial in los angeles. A hedge fund is an investment fund that invests large amounts of money using methods that involve a lot of risk. A hard hurdle rate means that incentive fees are only collected on returns in excess of the benchmark. Actively managed hedge funds aim to produce profits whatever happens in the stock market. Learn the differences between hedge funds and mutual funds. Hedge funds have a reputation for being somewhat mysterious, and at times controversial. An example of a hedge fund is a group of investors who have pooled their money to invest it in unconventional investments or to purchase speculative stocks. What does hedge fund mean in finance?